Analysis of Wednesday's Trades

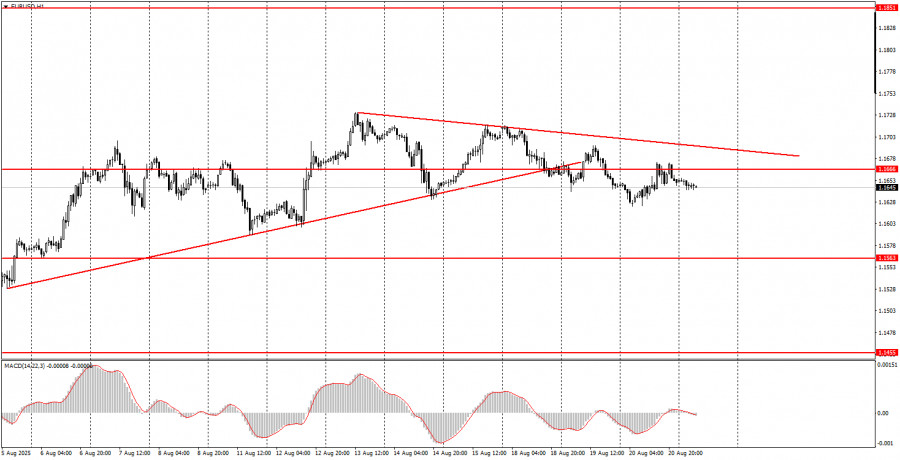

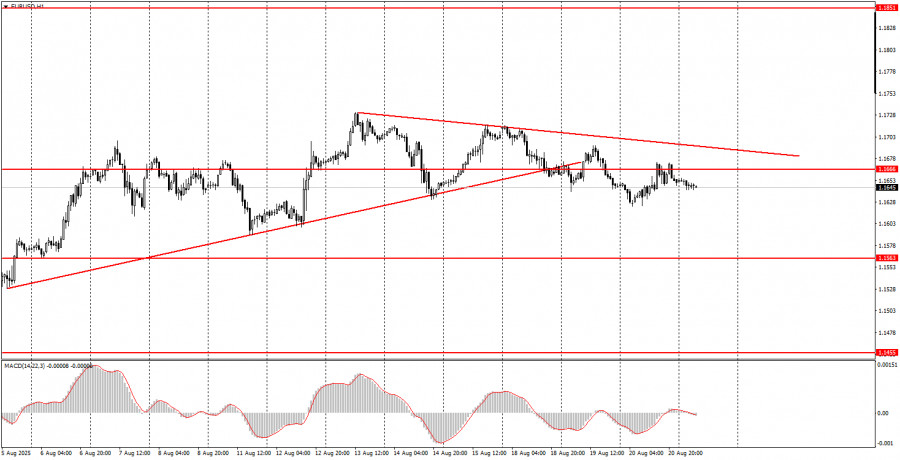

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair continued to move with minimal volatility and without a clear direction. More precisely, there is a direction—it has been sideways for a week. The macroeconomic background remains absent, and only today, the first reports of the week will start to be released, which could trigger a reaction from traders. However, even here, the chances are not very high. Business activity indices are certainly interesting reports, but European indices would need to show unexpected, resonant values to be properly priced in. For the U.S., such reports are of secondary importance, as traders tend to pay more attention to ISM indices. Thus, this morning we may see a short-term spike in emotions and volatility, but throughout the day, volatility is unlikely to increase much, and the flat movement will likely persist. Formally, a downward trend is in place, as indicated by the trendline. However, this trendline is more helpful in showing when the upward movement will resume.

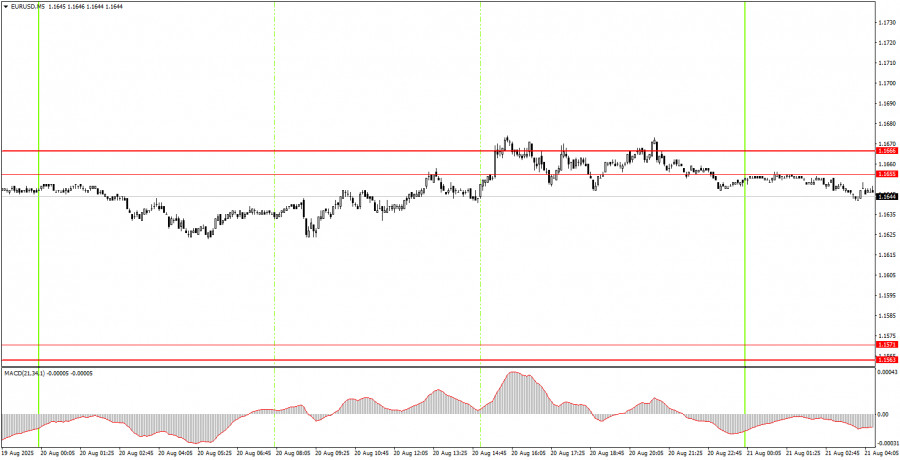

5M Chart of EUR/USD

On the 5-minute timeframe on Wednesday, the price repeatedly encountered levels on its path. We did not even mark these signals, since there was no volatility or meaningful movement in the market. In a flat market, any signal near any level cannot bring profit to traders, as there is simply no movement.

Trading Strategy for Thursday:

On the hourly timeframe, the EUR/USD pair has every chance to continue the upward trend that has been forming since the start of this year. However, the market is currently flat, so it is necessary to wait for its completion first. We still see no grounds for medium-term growth of the U.S. currency, so we believe the dollar can only count on minor technical corrections.

On Thursday, the EUR/USD pair may remain flat, as the macroeconomic background will be quite weak. Trading can be considered from the 1.1655–1.1666 area, but yesterday once again showed that while signals may form, movements will not necessarily become stronger because of them.

On the 5-minute timeframe, the following levels should be considered: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1552–1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908. For Thursday, Germany, the Eurozone, and the U.S. are scheduled to publish business activity indices in the services and manufacturing sectors for August. Traders may react to this data only because there is nothing else on the calendar. However, we still would not expect strong movements today.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.