Bitcoin has set a new mark above $112,000 and continues to trade above this level. Ethereum also increased significantly, but the short-term bear market remains stronger than yesterday's minor correction.

Meanwhile, according to SoSoValue data, outflows from spot BTC ETFs have turned into inflows, which could support growth in the cryptocurrency market in the near future. This reversal is undoubtedly a positive signal, hinting at easing selling pressure and possible restoration of investor confidence in Bitcoin—especially after the notable correction down to around $108,000. Inflows into ETFs essentially indicate demand for BTC from institutional players, who in turn may drive prices higher.

Inflows into BTC ETFs, expectations of lower interest rates in the US, and the opening of the crypto market to pension funds will be long-term factors supporting a bull market. These three pillars create a solid foundation for sustained growth, quite different from purely speculative rallies.

The prospect of the Federal Reserve lowering interest rates is a significant catalyst. Cheaper money fuels investment in risk assets, and Bitcoin, as the leading cryptocurrency, naturally attracts investors seeking higher returns than traditional instruments. This creates a favorable environment for further market expansion.

One of the most anticipated events is the opening of crypto markets to pension funds. These institutional giants manage trillions of dollars, and even a small allocation to Bitcoin could have a significant price impact. Moreover, the conservative approach of pension funds should help stabilize the market, reduce volatility, and attract long-term investors.

Finally, the steady inflow into spot BTC ETFs confirms growing institutional interest in Bitcoin. ETFs offer a convenient and regulated way to invest in Bitcoin, eliminating the need for direct cryptocurrency ownership. Rising inflows signal increasing acceptance of Bitcoin as a legitimate asset class.

For an intraday strategy in the cryptocurrency market, I'll continue to rely on major dips in Bitcoin and Ethereum, expecting the ongoing bull market to persist in the medium term.

For short-term trading, the strategy and conditions are described below.

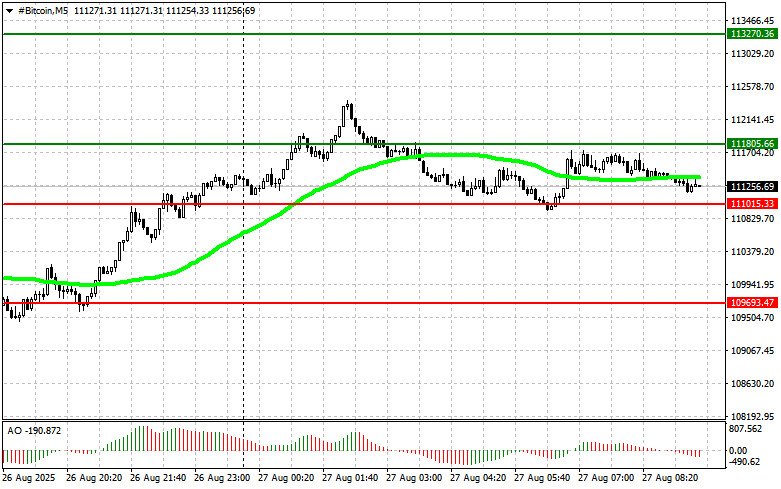

Bitcoin

Buy Scenario

- Scenario #1: I'll buy Bitcoin today if it reaches the entry area around $111,800 with a target of rising to $113,200. Near $113,200, I'll exit long positions and immediately sell on a pullback. Before buying a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: I can buy Bitcoin from the lower boundary of $111,000 if there's no market reaction to a breakout, targeting a reversal back toward $111,800 and $113,200.

Sell Scenario

- Scenario #1: I'll sell Bitcoin today if it reaches the entry area around $111,000 with a target of falling to $109,600. Near $109,600, I'll exit short positions and immediately buy on a pullback. Before selling a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: I can sell Bitcoin from the upper boundary of $111,800 if there's no market reaction to a breakout, targeting a reversal back toward $111,000 and $109,600.

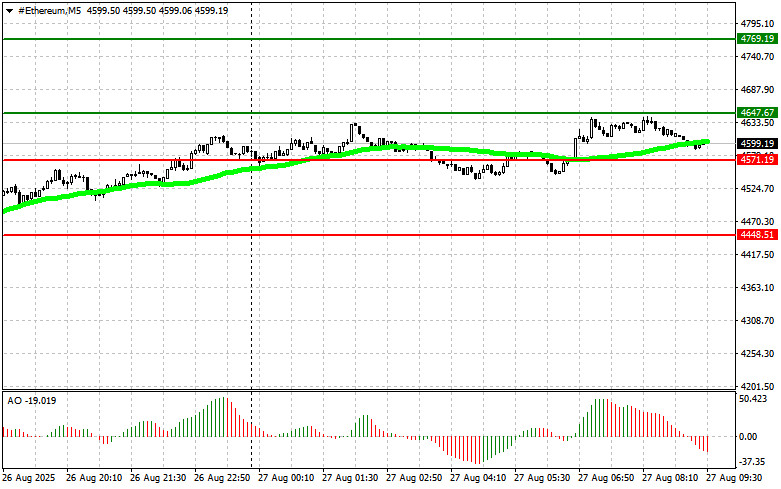

Ethereum

Buy Scenario

- Scenario #1: I'll buy Ethereum today if it reaches the entry area around $4,647, aiming for a rise to $4,769. Near $4,769, I'll exit long positions and immediately sell on the pullback. Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: You can buy Ethereum from the lower boundary of $4,571 if there's no market reaction to a breakout, targeting a reversal back toward $4,647 and $4,769.

Sell Scenario

- Scenario #1: I'll sell Ethereum today if it reaches the entry area around $4,571, aiming for a drop to $4,448. Near $4,448, I'll exit short positions and immediately buy on the rebound. Before selling a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: You can sell Ethereum from the upper boundary of $4,647 if there's no market reaction to a breakout, targeting a reversal back toward $4,571 and $4,448.