Trade Review and Trading Tips for the Euro

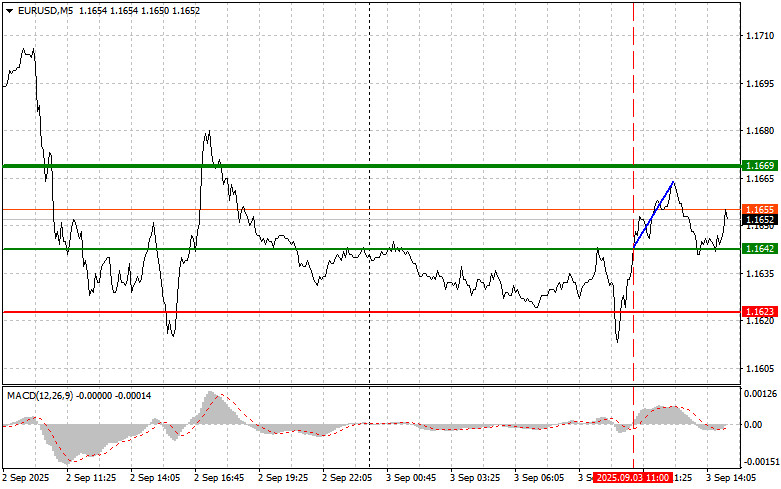

The test of the 1.1642 price level occurred when the MACD indicator had just started moving upward from the zero mark, which confirmed the correct entry point to buy euros. As a result, the pair rose by 25 points.

Mixed service sector PMI data from eurozone countries only temporarily pressured the euro. Given that the pair was quickly bought back, traders seem to maintain a positive outlook for the European economy despite concerns about inflationary pressure and the ECB's actions.

Today, in the second half of the day, the Bureau of Labor Statistics will release data on job openings and separations, and there will also be information on changes in factory orders. In addition, FOMC member Neel Kashkari is scheduled to speak. These events will certainly affect market sentiment. Particular attention will be paid to the JOLTS report, which helps assess the labor market by showing employer demand for new workers and the frequency of job switches among employees. An increase in job openings can indicate stable labor demand, which is generally a positive sign for the economy.

Meanwhile, data on changes in factory orders will help assess prospects for the industrial sector. An increase in orders generally precedes higher production volumes in the coming months, which may positively impact economic growth.

The importance of Neel Kashkari's speech should also not be underestimated. His remarks about the current economic situation and monetary policy outlook can provide investors with insight into how the Federal Reserve sees future developments. Market participants will closely monitor any signals of potential interest rate changes.

As for the intraday strategy, I will focus on Scenario #1 and Scenario #2.

Buy Signal

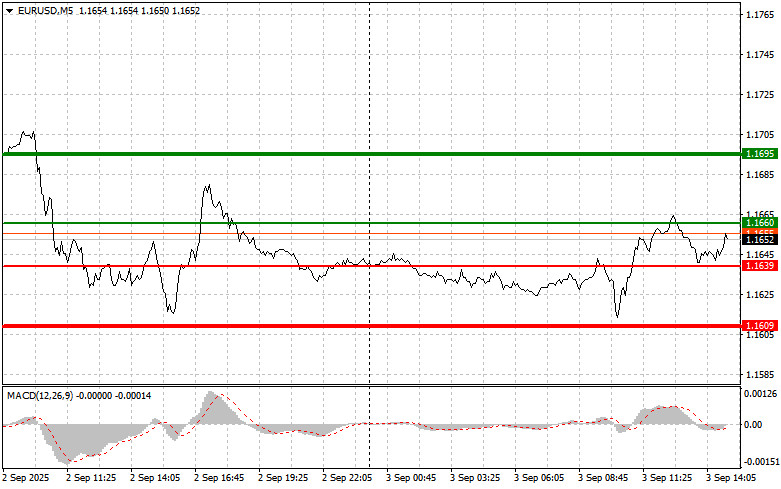

Scenario #1: Today, buying the euro is possible if the price reaches the level of 1.1660 (green line on the chart), with the target of rising to 1.1695. At 1.1695, I plan to exit the market and also sell euros in the opposite direction, targeting a 30–35 point move from the entry point. Strong euro growth today is only likely after weak statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1639 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and may trigger a reversal upward. Growth toward the opposite levels of 1.1660 and 1.1695 can be expected.

Sell Signal

Scenario #1: I plan to sell euros after the price reaches the 1.1639 level (red line on the chart). The target will be 1.1609, where I plan to exit the market and buy immediately in the opposite direction (targeting a 20–25 point move from the level). Pressure on the pair could return today if reports are strong. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell euros today if there are two consecutive tests of the 1.1660 price level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels of 1.1639 and 1.1609 can be expected.

Chart Legend:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – expected price to set Take Profit or manually fix profit, as growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – expected price to set Take Profit or manually fix profit, as further decline below this level is unlikely;

- MACD Indicator – when entering the market, it is important to use overbought and oversold zones.

Important: Beginner Forex traders should make market entries with great caution. Before important fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Trading without stops can quickly result in a total loss of your deposit, especially if you do not use money management and trade large lot sizes.

And remember: for successful trading, you must have a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are fundamentally a losing strategy for intraday trading.