Trade Analysis and Advice on Trading the British Pound

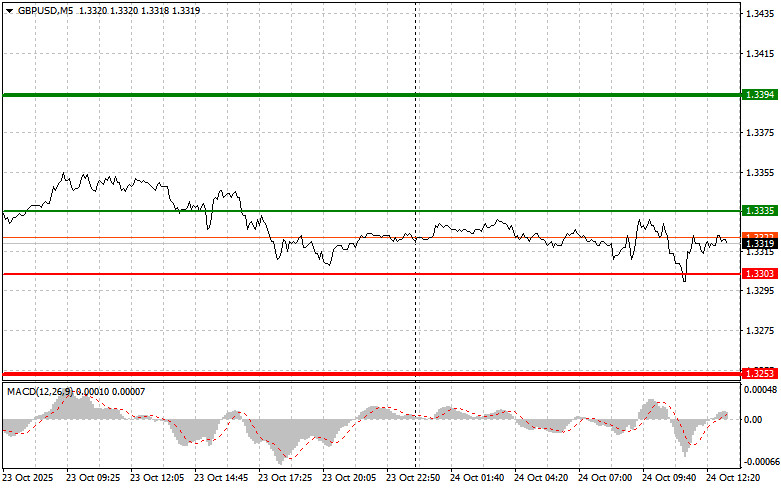

The price test at 1.3309 occurred when the MACD indicator had already moved far below the zero line, which limited the pair's downward potential — especially given that buyers had been defending this level throughout the week.

The UK manufacturing PMI in October approached the 50-point mark. This improvement allowed pound holders to overcome the pressure felt in the first half of the trading day. The increase in this indicator, which reflects the state of the industrial sector, came as an unexpected signal of optimism for investors. In September, when the PMI fell to 46.2, the market recorded clear signs of a slowdown: orders were shrinking, inventories were building up, and export prospects were dimming under the influence of global trade barriers. However, the October data published by S&P Global changed the mood. The reading of 49.6, though still below the 50 threshold that signals expansion, indicates stabilization.

The second half of the trading day could bring volatility, especially after the release of key U.S. Consumer Price Index (CPI) data. This indicator, as a barometer of inflation trends, can turn market sentiment upside down. Analysts expect that the September numbers will show a rise in prices. If the actual data turns out to be softer than expected, the Federal Reserve may continue to cut interest rates more actively, which would support the pound.

In addition to the CPI, investors will closely monitor the composite business activity indices — the manufacturing PMI and the ISM services index. The trio of economic releases will be rounded out by the University of Michigan Consumer Sentiment Index.

As for intraday trading strategy, I will rely more on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound when the price reaches the 1.3335 level (green line on the chart), targeting growth to the 1.3394 level (thicker green line on the chart). Around 1.3394, I plan to exit long positions and open short positions in the opposite direction, expecting a 30–35-point pullback. A strong rise in the pound today is only possible if U.S. inflation turns out to be very weak.Important! Before buying, make sure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3303 level, when the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.3335 and 1.3394.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks below the 1.3303 level (red line on the chart), which will likely lead to a rapid decline in the pair. The key target for sellers will be the 1.3253 level, where I plan to exit short positions and immediately open long positions in the opposite direction, expecting a 20–25-point rebound. The pound may drop sharply in the second half of the day.Important! Before selling, make sure that the MACD indicator is below the zero line and is just starting to move downward from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3335 level, when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.3303 and 1.3253.

Chart Legend

- Thin green line – entry price where the trading instrument can be bought

- Thick green line – estimated price level for setting Take Profit or manually fixing profit, as further growth above this level is unlikely

- Thin red line – entry price where the trading instrument can be sold

- Thick red line – estimated price level for setting Take Profit or manually fixing profit, as further decline below this level is unlikely

- MACD Indicator – when entering the market, it is important to consider overbought and oversold zones.

Important Note for Beginner Forex Traders

Beginner traders in the Forex market should make entry decisions very carefully. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember: For successful trading, you need to have a clear trading plan, like the one presented above. Spontaneous trading decisions, based on the current market situation, are an inherently losing strategy for an intraday trader.