Trade Analysis and Advice on Trading the Japanese Yen

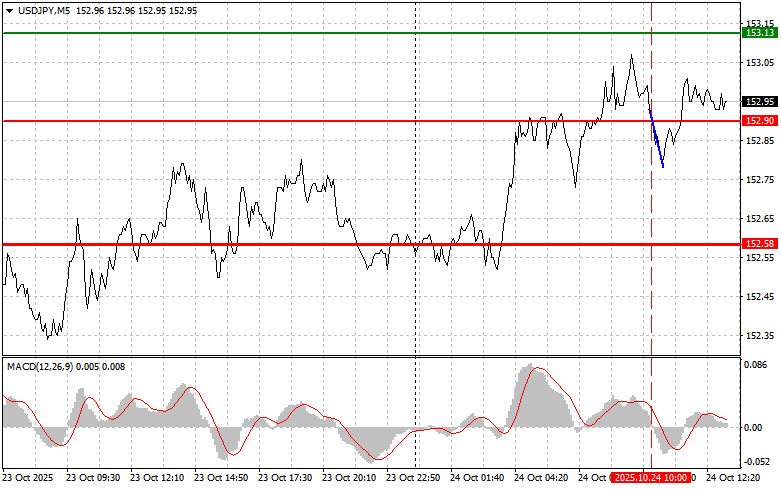

The price test at 152.90 in the first half of the day occurred when the MACD indicator had just started moving downward from the zero line, confirming a valid entry point for selling the dollar — which resulted in only a 10-point decline.

The second half of the trading day promises to become an arena of intense market battles, with new U.S. economic indicators taking center stage. The publication of the Consumer Price Index (CPI) will be the opening gong, resonating across the entire financial spectrum — especially given its delayed release due to the government shutdown. If the figures exceed expectations, reinforcing the view of persistent inflationary pressure, the dollar will strengthen, and the USD/JPY pair will move higher.

Next on stage come the business activity indexes, which reflect the pulse of the U.S. economy. The manufacturing PMI will capture ongoing tension in supply chains, where geopolitical storms — from trade wars to the energy crisis — continue to sow chaos. Weak readings here would put pressure on the dollar. The University of Michigan Consumer Sentiment Index will serve as the final act. Strong data across all fronts — CPI, PMI, and ISM — will likely push USD/JPY into another rally, potentially breaking through the 153.00 level and reinforcing the dollar's global dominance.

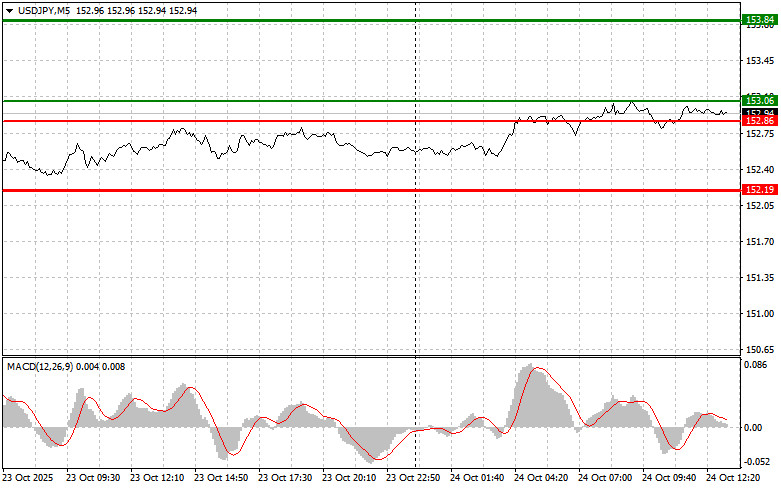

As for intraday trading strategy, I plan to focus mainly on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY when the price reaches the 153.06 level (green line on the chart), targeting growth toward 153.84 (thicker green line on the chart). Around 153.84, I plan to exit long positions and open short positions in the opposite direction, expecting a 30–35-point correction. Further upside in the pair is possible within the framework of a new trend.Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 152.86 level, when the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. A rise can be expected toward the opposite levels of 153.06 and 153.84.

Sell Signal

Scenario #1: I plan to sell USD/JPY after the price breaks below 152.86 (red line on the chart), which will likely lead to a rapid decline in the pair. The key target for sellers will be 152.19, where I plan to exit short positions and immediately open long positions in the opposite direction, expecting a 20–25-point rebound. Strong downward pressure could return if U.S. inflation falls sharply.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 153.06 level, when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 152.86 and 152.19.

Chart Legend

- Thin green line – entry price at which the trading instrument can be bought

- Thick green line – estimated level for placing Take Profit or manually fixing profit, as further growth above this level is unlikely

- Thin red line – entry price at which the trading instrument can be sold

- Thick red line – estimated level for placing Take Profit or manually fixing profit, as further decline below this level is unlikely

- MACD Indicator – when entering the market, it is important to take into account overbought and oversold zones.

Important Note for Beginner Forex Traders

Beginner traders in the Forex market should make entry decisions very carefully. Before the release of major fundamental reports, it is best to stay out of the market to avoid exposure to sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you ignore money management principles and trade with large volumes.

And remember: For successful trading, you must have a clear trading plan, such as the one presented above. Spontaneous trading decisions, made based on the current market situation, are an inherently losing strategy for an intraday trader.