Trade Analysis and Advice on Trading the European Currency

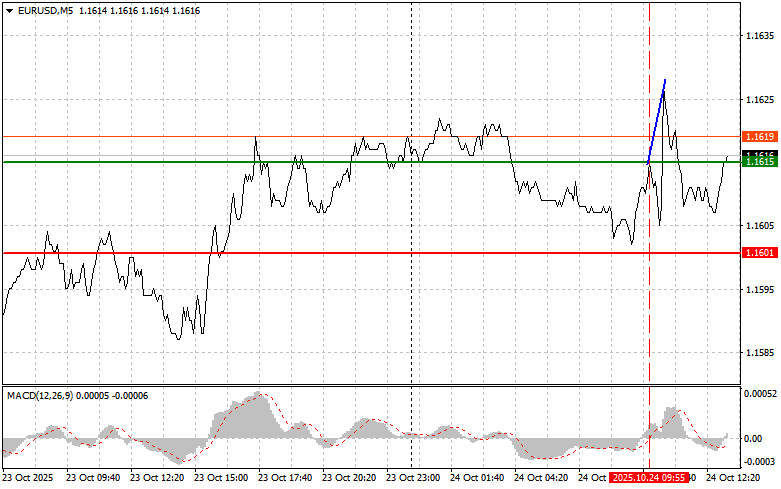

The price test at 1.1615 occurred when the MACD indicator had just started to move upward from the zero mark, confirming the correct entry point for buying the euro. As a result, the pair rose by only 15 points.

Euro buyers reacted positively to the return of the Eurozone manufacturing PMI to a neutral level. The recovery of the manufacturing PMI to 50 points indicates positive shifts in the dynamics of the economy.

In the second half of the day, investors' focus will inevitably shift to important U.S. inflation data, including the Consumer Price Index (CPI) and its core version, which excludes volatile components such as food and energy. These figures set the tone for expectations regarding the Federal Reserve's interest rate path. In an environment of global turbulence—where inflationary risks from supply chain disruptions and geopolitical conflicts continue to grow—even a minor deviation from expectations can trigger volatility, strengthening or weakening the dollar.

At the same time, updated data on U.S. business activity indexes in manufacturing, services, and the composite PMI will also be released. These indicators capture the rhythm of the economy. Manufacturing fluctuating within the 50–52 range points to a fragile balance between demand and recession risks, while the services sector reflects stable consumer demand. The composite PMI, integrating both sectors, will provide a comprehensive picture — if it exceeds 52, it will reinforce confidence in a smooth normalization of the U.S. economy, potentially supporting the dollar.

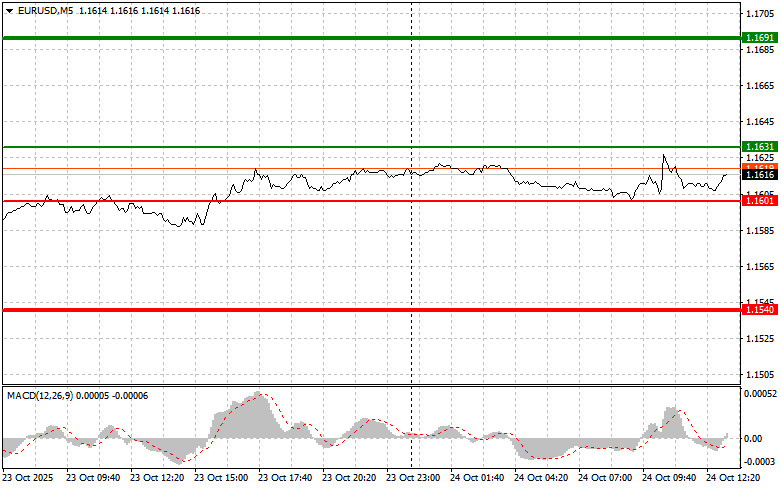

As for intraday strategy, I will rely more on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: Today, it is possible to buy the euro at around 1.1631 (green line on the chart) with a target of rising to 1.1691. At 1.1691, I plan to exit the market and also open a sell position in the opposite direction, expecting a movement of 30–35 points from the entry point. A rise in the euro today is only likely if U.S. inflation drops sharply.Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1601 level, at a moment when the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.1631 and 1.1691.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1601 level (red line on the chart). The target is 1.1540, where I intend to exit the market and immediately buy in the opposite direction, expecting a 20–25 point rebound. Pressure on the pair may rise significantly if inflation increases.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to move down from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1631 level, when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.1601 and 1.1540.

Chart Legend

- Thin green line – entry price for buying the instrument

- Thick green line – expected level for placing Take Profit or manually locking in profit, since further growth above this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – expected level for placing Take Profit or manually locking in profit, since further decline below this level is unlikely

- MACD Indicator – when entering the market, pay attention to overbought and oversold zones.

Important Note for Beginner Forex Traders

New traders in the Forex market should make entry decisions very carefully. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember: To trade successfully, you must have a clear trading plan, such as the one presented above. Spontaneous trading decisions, based on current market fluctuations, are an inherently losing strategy for an intraday trader.