The EUR/USD pair clearly shows readiness to resume its upward trend. For more than a week, the European currency has been slowly drifting downward amid a complete absence of news, macroeconomic releases, and fundamental events. During this time, we have repeatedly noted that what we are seeing is merely a technical correction, nothing more. The U.S. dollar still has no chance of medium-term growth, as the broader fundamental backdrop remains against it. Moreover, with Donald Trump in power, the priorities of the U.S. economy have shifted significantly. Whereas previously a "strong" dollar caused little concern (the U.S. currency had been rising for about 16 years on the FX market), Trump has taken a course toward boosting exports and balancing trade. Thus, a "weak" dollar benefits the U.S., as it makes American products more competitive globally. This means the dollar's decline plays into the hands of the new White House administration, and no one will step in to prevent its fall.

This alone allows us to forecast that the U.S. dollar will continue to decline. Another significant factor is the ongoing trade war. In other words, one of the main reasons for the dollar's weakness in the first half of 2025 remains in place. New tariffs are introduced at an alarming rate, old ones are raised, and threats and ultimatums continue to pour out of the White House. There is no sign of de-escalation.

Another crucial factor: the dollar fell during the first six months of 2025 even with the Federal Reserve maintaining a hawkish stance, while the European Central Bank and the Bank of England were easing policy. What should be expected from the dollar in the second half of 2025, once the Fed inevitably resumes its easing cycle? Whether the key rate falls quickly or slowly no longer matters. The market understands that in the next nine months (while Powell remains Fed Chair and Trump has not yet replaced half of the FOMC with his own appointees), rates may fall gradually in line with economic conditions and the central bank's mandate. But in 2026, once Trump's candidate becomes Fed Chair and the FOMC is reshaped with his allies, rates could be cut regardless of inflation or labor market conditions. Therefore, we continue to expect only further decline of the U.S. currency.

Next week in the Eurozone, macroeconomic events will be scarce. In any case, macro data is the last thing traders are paying attention to right now. The most notable reports will come on Friday. Germany will release data on retail sales, unemployment, and inflation. We believe traders reading this article understand that these data have virtually no chance of influencing market sentiment, even the inflation report. The ECB has practically completed its easing cycle, and inflation across the Eurozone has stabilized around 2%. The ECB's target has been achieved, and minor fluctuations in the CPI near 2% are irrelevant.

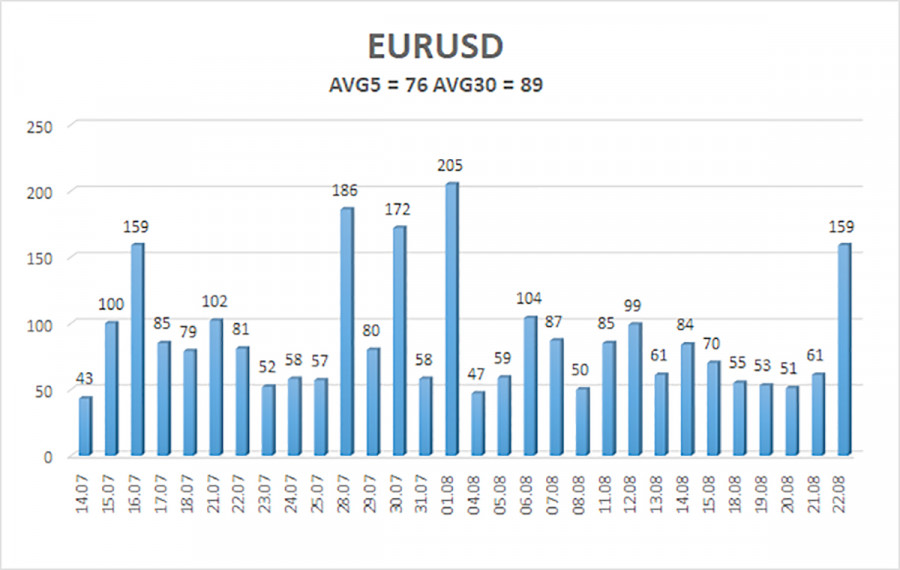

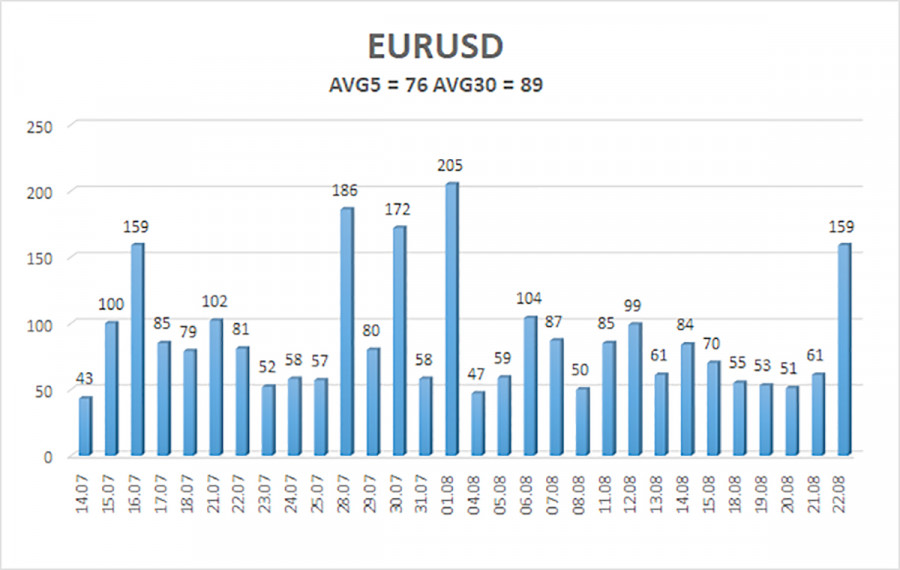

The average volatility of EUR/USD over the last five trading days as of August 23 is 76 pips, which is characterized as "medium." We expect the pair to move between 1.1645 and 1.1797 on Monday. The long-term linear regression channel points upward, still indicating an uptrend. The CCI indicator entered the oversold zone three times, warning of a resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

Nearest Resistance Levels:

R1 – 1.1780

R2 – 1.1841

Trading Recommendations:

The EUR/USD pair may resume its uptrend. The U.S. dollar is still heavily influenced by Trump's policies, and he shows no sign of "stopping here." The dollar rose as much as it could, but now it seems time for another leg of prolonged decline. If the price is below the moving average, small shorts may be considered with targets at 1.1597 and 1.1536. Above the moving average, long positions remain relevant with targets at 1.1780 and 1.1797 in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.